MCC now has add functionalities and a new interface

Now you can include Retirement and VA Disability in your calculations.

Our pricing

Prices in USD. Taxes may apply.

MCC

Military Compensation Calculator

Getting a job is hard. Comparing compensation shouldn't be

The MCC is your ticket to financial certainty when comparing job offers to your military pay.

The MCC translates components of military compensation into civilian terms, and calculates the taxation correctly

Pays

The base pay is our foundation, but some jobs also receive other types of pays and bonuses. And, you can receive additional pays if you are deployed.

Allowances

Allowances such as BAH, BAS, DLA, and others can vary greatly by geography, pay grade, and whether or not you have dependents.

Benefits

Many benefits are offered, including free health care, PX/BX/NEX, fitness facilities, subsidized childcare, and legal advice, among others.

The MCC walks you through how to easily compare military to civilian pay:

Allowances can be a significant portion of your total military compensation, especially if you live in a high cost of living area where BAH is high.

Since allowances are not taxed, figuring out how an equivalent civilian gross pay requires us to calculate the taxes that you would have to pay in order to net, after taxes, the same amount as your current allowances.

There are 3 types of income taxes that most of us pay: Federal, FICA, and State.

Federal: There are 7 federal graduated income tax brackets. Your bracket depends on your taxable income and filing status.

FICA: Federal Insurance Contributions Act (FICA) funds Social Security and Medicare programs. The Social Security tax rate is 6.2% for up to $176,100 in income for 2025, and the Medicare tax rate is 1.45% for all earned income.

State: Each state has its own income tax laws:

-8 states levy no income taxes.

-Washington state only taxes capital gains income, not earned income.

-14 states levy a single tax rate (so 1 rate regardless of how much you earn).

-27 states and the District of Columbia levy graduated-rate income taxes, with the number and size of brackets varying widely by state.

The MCC does all the calculations for you and displays the amount of each tax (federal, FICA, and state) on a waterfall chart.

On the far right of the waterfall chart is the equivalent gross amount you would have to earn in order to net the same amount of money as you currently do with your BAH, BAS, and other allowances.

Active Duty military can declare and maintain a "domicile" in one state while being stationed in a different state.

One advantage of this benefit is that you can declare domicile, and pay income taxes, in a low- or no-income tax state while you on Active Duty status with the military. (Contact your JAG for details.)

However, once you leave Active Duty, you typically need to pay income taxes where you live (contact an attorney for specifics).

If you are domiciled in a low- or no-income tax state, then you leave the military, your state income tax bill could be quite large, depending on which state you declare domicile in.

The MCC has state-level income tax calculations built-in, so you can input any 2 states and see how your income taxes are affected.

NOTE: The income tax calculations are only estimates. Consult a tax professional regarding your specific situation.

Determining your out-of-pocket health care spend can be exceptionally challenging for civilians and transitioning military alike.

Below are the basics of health insurance in the civilian sector - the terms most often used to define civilian healthcare. I highly encourage you to learn more about health care costs elsewhere (civilian neighbors, friends who have gotten out already), so you're not blind-sided once you get out of the military.

There are 3 categories of health insurance: Medical, Dental, and Vision. Each category is usually billed separately.

Premium is the monthly fee you pay to have insurance coverage - similar to car insurance or renter's insurance.

Copay is a fixed fee you pay when you receive covered care like an office visit or pick up prescription drugs.

EXAMPLE: Your copay for a doctor’s visit is $25. This means you will pay $25 for each visit to your doctor.

Coinsurance is a set percentage you pay for a covered service.

EXAMPLE: Your coinsurance is 25%. If a doctor’s appointment costs your insurance company $100, then you would pay $25 at the doctor's office.

NOTE: In most cases your copay will not go toward your deductible.

Deductible is the amount of money you must pay out-of-pocket toward covered benefits before your health insurance company starts paying.

EXAMPLE: Your annual deductible is $3,000. This means you have to pay $3,000 out-of-pocket to meet your deductible before your insurance will pay for your care.

For Active Duty members, TRICARE Prime charges zero for all of the above. So if all those terms above are new to you, that's ok.

For Reserve and National Guard members, TRICARE Reserve Select premiums are typically lower than most companies' insurance plan premiums.

For all veterans, if you seek out medical care at your local VA clinic, there is typically no cost for that healthcare.

Trying to estimate the number of doctor's visits is like predicting the future.

Health insurance is almost never free as a civilian, so know that you will most likely be paying for it, leaving you with less take-home pay.

The fundamental difference between military leave and civilian paid time off (PTO) is how each treats the days when you're not scheduled to work.

The military typically requires you to take leave days if you're traveling, even if you're not scheduled to work. So, if you work Monday-Friday, and take a 5-day trip to visit your family out of town from Thursday through Monday, then you must take 5 days of leave - even though you're missing only 3 days of work.

In the civilian world, you must take days off for only the days you were scheduled to work. So, in the same example above, you would need to take only 3 days of PTO.

The two extreme situations for military leave are highlighted below. On the left, the "Avid traveler" flies 15 weekends each year to visit friends. He must take 2 days of leave for each trip, and he thus uses all 30 days of his annual leave on the weekends. As a result, he gets no additional days off work. Living the opposite situation is the "Staycationer". She never travels, so all of her leave is taken locally, and thus she can take off all 30 of her leave days for work days.

As a result of this difference, there is no singular answer to "How much civilian PTO is equivalent to military leave?", because it will depend on how many leave days you use on the weekends and holidays.

When you compare total time off in the military to that of a civilian job, don't forget about the 11 Federal Holidays the military typically gives, as well as the generous 4-day passes for some of those holidays.

Now you see the logic behind how to compare your current military leave with civilian PTO.

If you use the childcare facilities on your military installation, this may be a significant subsidy for you.

The Child Development Center (CDC) bases its fees on your total household income. The lower your household income, the less you pay.

Unless your prospective civilian employer has childcare subsidies, you will pay the same market rate that other civilians pay.

Research childcare options in the local area where you are planning to live. Then find the difference between your current CDC childcare rate and the prospective civilian childcare rate.

Also note that the added childcare expenses are after-tax dollars unless your employer offer a Flexible Savings Account, which allows you to use pre-tax dollars for expenses like childcare.

For example, if you calculate that your childcare costs will be $400 per month higher at a civilian childcare facility compared to the CDC, you would need to earn $550-$650 more per month, then pay taxes on that amount, in order to end up with $400 after-tax to pay for childcare.

To calculate this equivalent pre-tax amount, input the difference as an additional "Allowance" in the MCC.

The "Allowances" section of the MCC calculates the pre-tax amount you would need to earn in order to net, after taxes, the same amount of subsidy you currently get with the on-installation childcare.

There are a number of smaller benefits that come with military service, including:

Commissary, BX/PX/NEX - Possibly cheaper prices, definitely no sales tax.

Fitness facilities - Free use of facilities, classes, and sporting events.

Legal - Powers of Attorney, wills, notaries, contracts, and other services.

Tax preparation services - Free on many military installations.

MWR/ITT - Discounted equipment rentals and event tickets.

Military discounts - With ID card - military friendly businesses in local installation area; some national chains.

Estimating an exact amount for these items may be challenging, but keep these in mind so you don't forget.

Here is how the MCC works

Once you log in, enter your information into the 4 sections described below.

Have your LES (Leave and Earnings Statement) handy so you can confirm that you're including all of your current pays and allowances.

Enter your name, "Current" or "Projected" calculation option, and branch of service.

VIDEO GUIDANCE FOR STEP 1Enter your year for calculations, military pays, other sources of income, and income tax information.

VIDEO GUIDANCE FOR STEP 2Enter your allowances - BAH (Basic Allowance for Housing), BAS (Basic Allowance for Subsistence), and any other allowances.

VIDEO GUIDANCE FOR STEP 3Estimate your post-military healthcare costs, as well as the value of services like childcare, Commissary, BX/PX/NEX, JAG, fitness facilities, and MWR/ITT.

VIDEO GUIDANCE FOR STEP 4The tool shows you the equivalent civilian pay, with charts showing the estimated income tax liabilities for federal, FICA, and state, given your inputs.

You can access your report in 3 formats

You have the ability to toggle between the 3 versions available for showing how your current military compensation translates into an equivalent civilian salary.

Each version has its own downloadable PDF so you can download for quick and easy future reference.

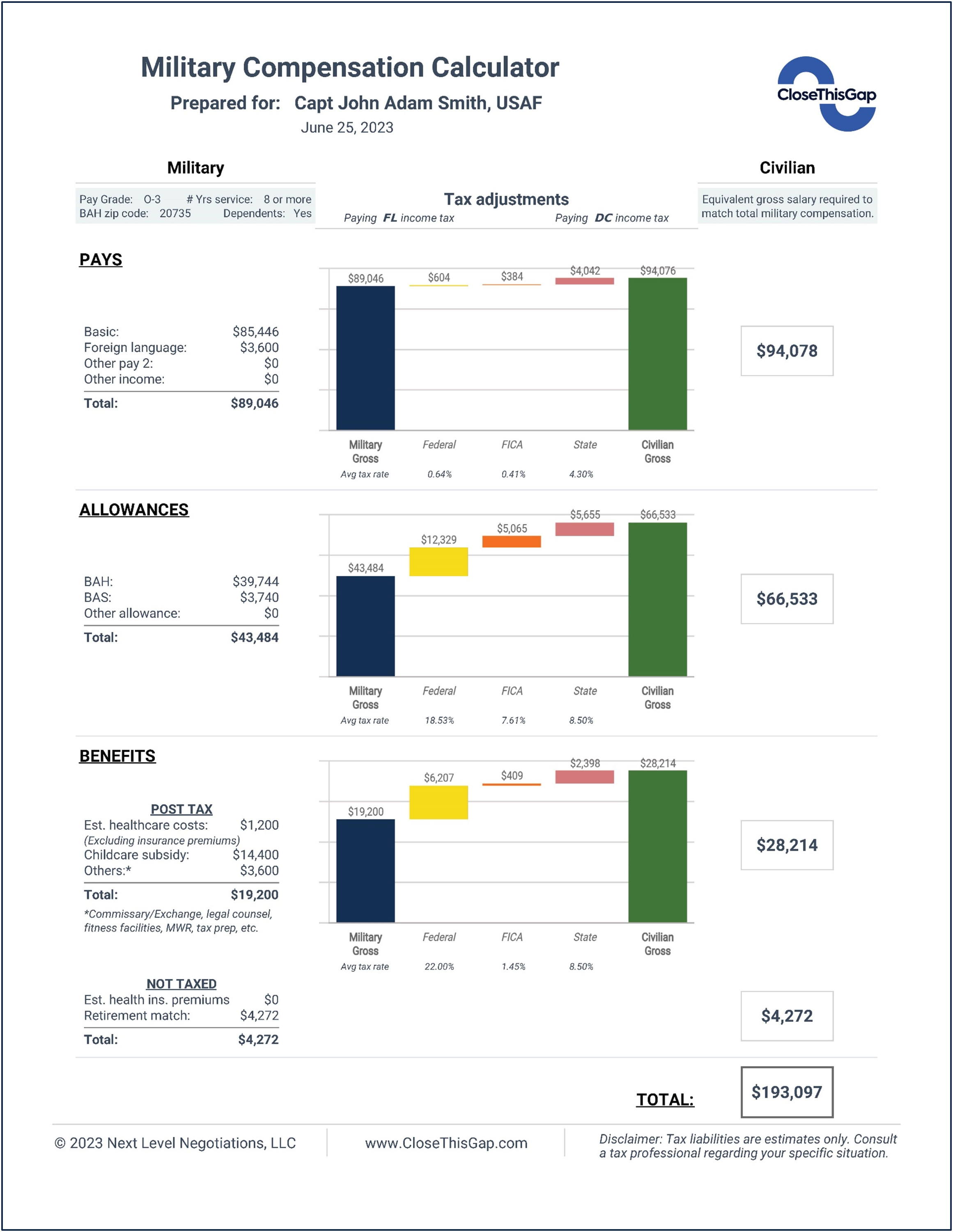

The Simple versionis the easiest format to read and digest. It displays only your military gross compensation and the estimated equivalent civilian gross salary.

The Pays section shows the differences in income taxes between your current and projected domicile state. The taxes may be higher, lower, or the same, depending on which two states you input.

The Allowances section shows the income taxes you would have to pay in order to net your current allowances amount. Since military allowances are not subject to any income tax, there typically is a substantial tax advantage.

The Benefits section has two components. The Post Tax Benefits cover out of pocket healthcare costs, childcare subsidies, and the benefits of the optional services on military installations. The Not Taxed Benefits are your estimated healthcare premiums and current retirement match (applies only to those enrolled in BRS).

Lastly, the bottom right corner shows your estimated equivalent civilian gross salary, taking into account all tax advantages of your current military compensation.

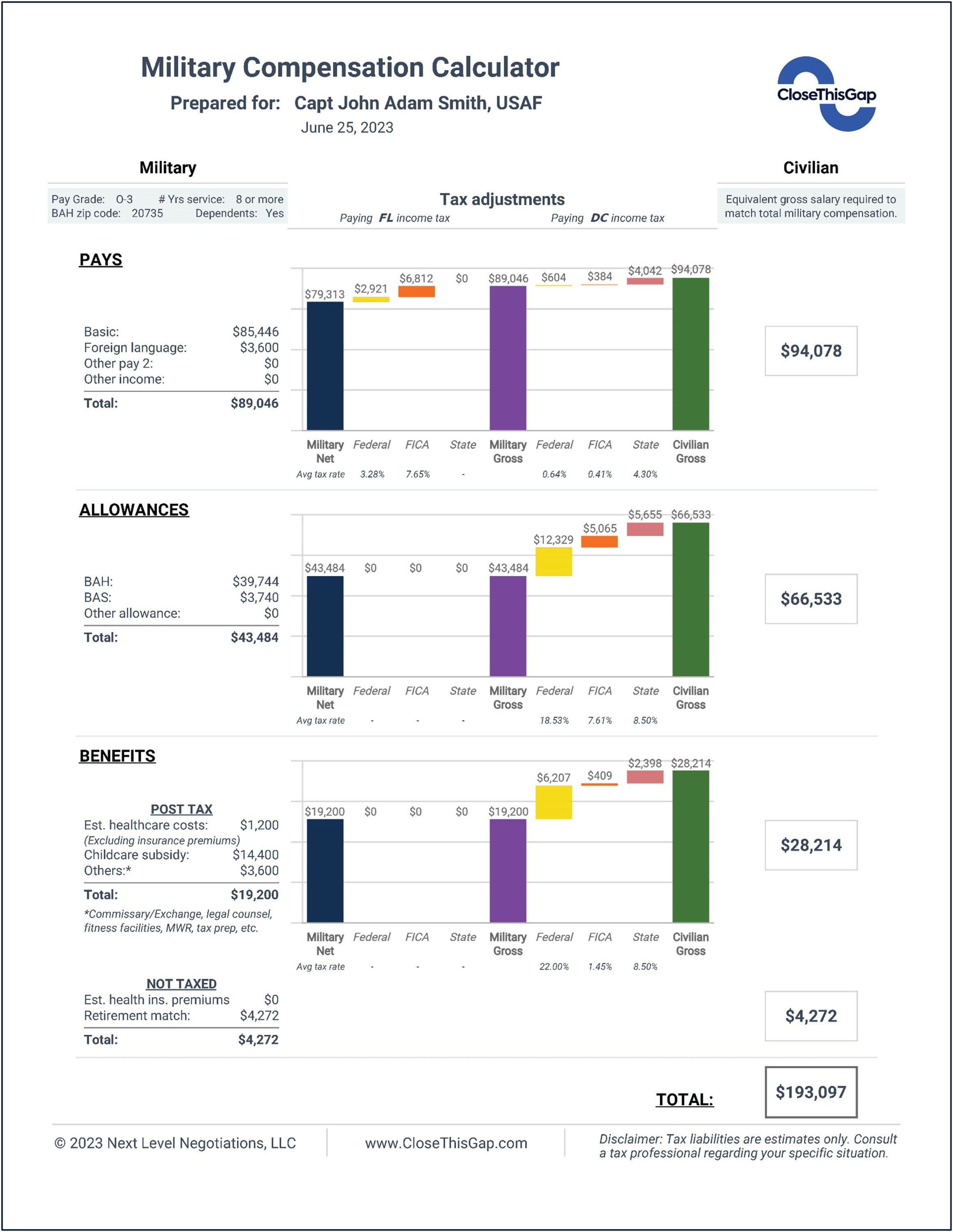

The Complex Summary has more detail than the Simple Summary.

It displays the same information as the Simple Summary. In addition, it calculates your current military net compensation, after paying your current estimated income taxes.

The Pays section has 4 additional columns that show your current estimated income taxes on your current military gross pay.

The Allowances section also has 4 additional columns that show your $0 current tax liability on your allowances - a substantial tax savings.

Similarly, the Benefits section's two components show the $0 current tax liability on your Post Tax Benefits, as well as the value of your Not Taxed Benefits.

Lastly, the bottom right corner shows the same estimated equivalent civilian gross salary.

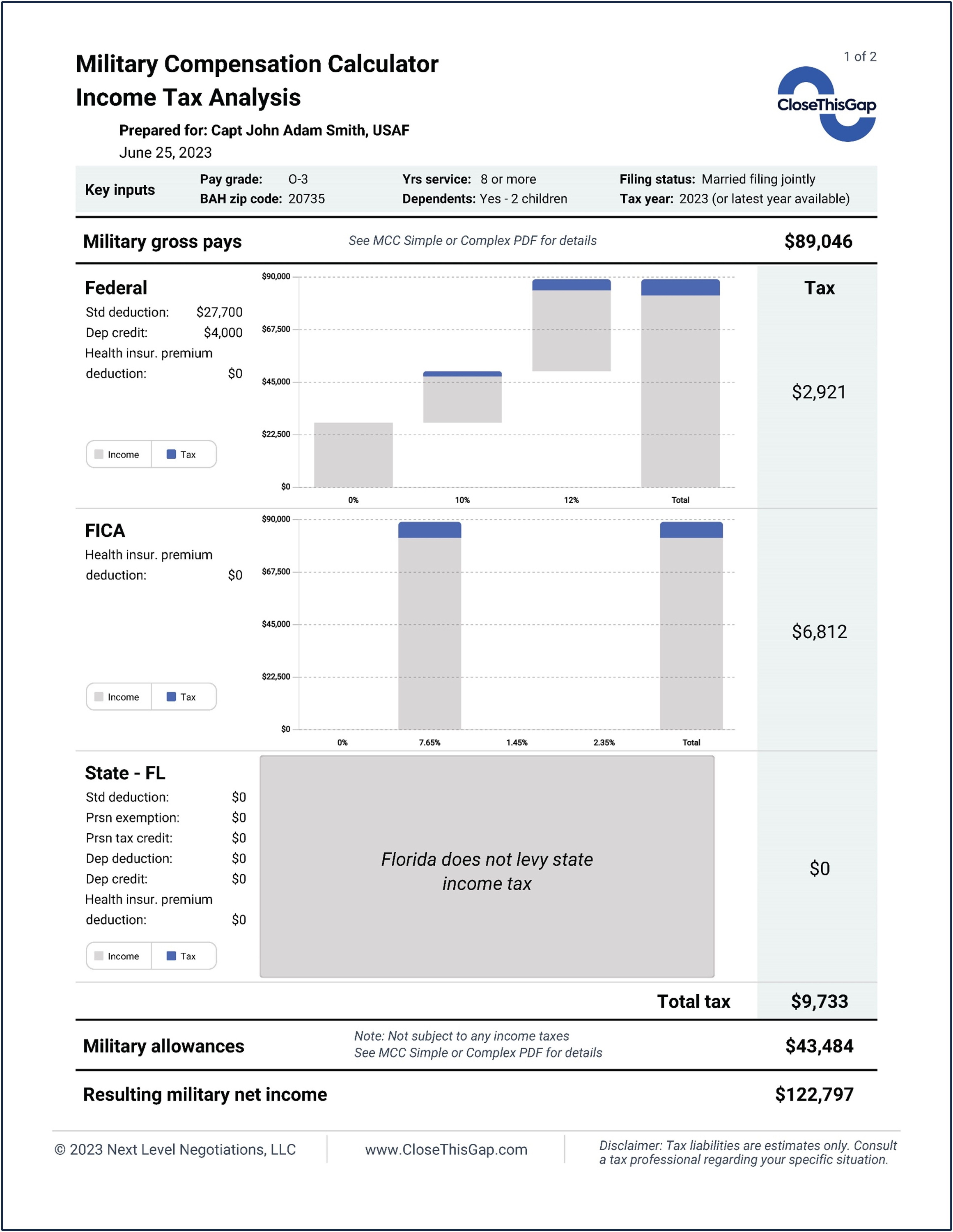

PAGE 1

(shown at right)

This page shows an estimate of your current military income tax liability.

The Federal section shows your estimated federal income tax liability on your pays. It shows the income amount of each bracket and the percent of tax levied on each bracket.

Similarly, the FICA section shows your estimated FICA income tax liability, including brackets and amounts.

Next, the state section shows your estimated state tax liability for the state you selected. In this example, there are no state taxes because Florida does not levy an income tax.

After we calculate your current taxes, we add your allowances onto your income. Doing so results in your resulting military net income.

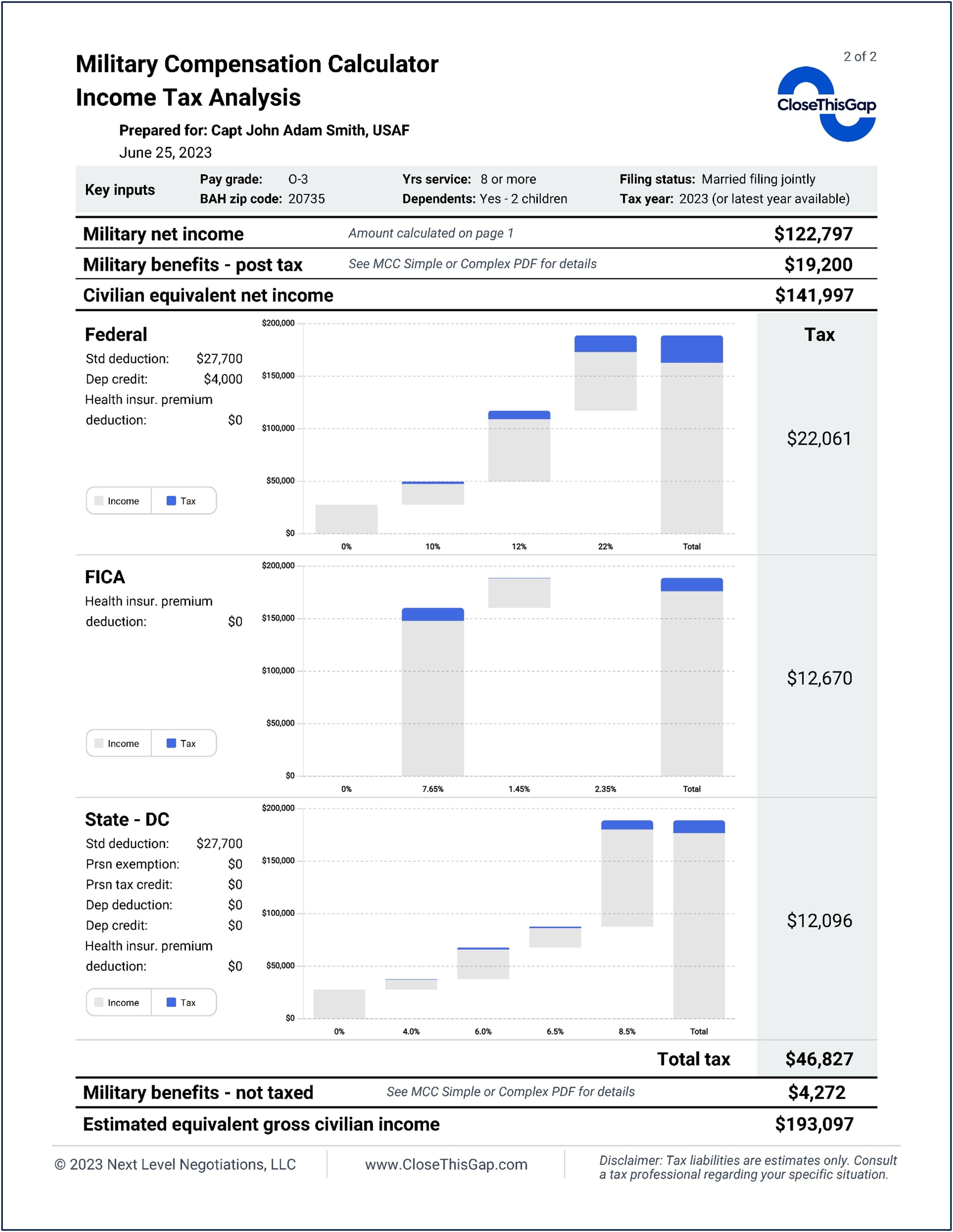

PAGE 2

(shown at right)

Page 2 walks through converting your current military net income into your estimated equivalent civilian gross salary.

It starts with the same military net income from the bottom of page 1.

It then adds in the Post Tax military benefits - benefits you will have to pay for using your after-tax income.

Adding those two amounts is your civilian equivalent net income. In order to net this amount as a civilian, the charts below show the gross income you need to earn, then pay Federal, FICA, and State income taxes on it (in this example, Washington, DC taxes), in order to net your current military income.

Lastly, we add back in the Not Taxed military benefits.

The amount at the bottom of page 2 is your estimated equivalent gross civilian income.

Our pricing

Prices in USD. Taxes may apply.

Still have questions about MCC? Read our FAQ

Yes we do. Those tax-free allowances and benefits can be substantial. In fact, the MCC may turn into an unintentional recruiting and retention tool for the DoD. That wasn’t my goal when I was developing the product, but here we are.

This is a completely understandable question! The MCC can seem more complicated than other pay calculators out there. There are more inputs, and it takes time to think through all assigning values to your benefits.

However, this is the only way for you to get a financially accurate picture of your current military compensation, and then convert that into an equivalent civilian gross salary.

Keep in mind that the fewer questions you ask about your unique circumstances, the less accurate your civilian salary estimate will be.

Yes - called the Regular Military Compensation (RMC) Calculator. Unfortunately, it is overly simplistic, inaccurate, and mostly under-estimates total military compensation, for several reasons:

1. For federal taxes, the RMC uses only the tax bracket of the highest dollar earned to compute the tax advantage on the allowances. It does not take into account crossing into a higher tax bracket, which could easily occur if your BAH is in a high cost-of-living zip code.

2. The RMC does not compute any FICA tax savings, which is 7.65% on the first $168,600 of income for 2024. (FICA tax has lower rates for incomes above $168,600).

3. The RMC does not include child tax credits for federal and state taxes (some states offer one, others do not). The RMC “Family Size” input is used solely to output BAH “with dependents” or “no dependents”.

4. The RMC does not allow the member to adjust the standard deduction amount. So, if you itemize on your taxes, your tax liability will likely be lower.

5. The RMC does not allow you to input any additional income, whether military income (like foreign language proficiency, aviation incentive, and health profession incentive) or other family income (such as spousal income, side business, and real estate investments). These could shift the member into a higher marginal tax bracket, thus increasing the current tax savings on BAH and BAS.

6. The RMC does not allow the member to estimate the value of military benefits, including healthcare costs, childcare subsidy, commissary, legal and tax advice, fitness facilities, and MWR/ITT. These benefits may or may not be offered at a civilian job.

7. The RMC does not compute any state income tax estimates. This includes those on Active Duty who domicile for tax purposes in a low- or no-income tax state, then must switch to a higher income tax state as a civilian.

The MCC takes into account all of the above to give a servicemember a significantly more accurate picture of their total military compensation, given their unique situation.

Yes – and please feel free to check them out. None compares to the level of detail or thoroughness of the MCC. The ones listed below are all free to use:

-DoD's Regular Military Compensation (RMC) Calculator. See above FAQ question for my comments on its accuracy.

-USA Learning - links directly to DoD's RMC - no additional calculations here.

-Financial Frontline - has 2020 Federal Tax standard deductions listed, which is now 3 years out of date. What else is inaccurate on there?

-Veterans.com - shows non-taxable vs taxable income on a pie chart, but does not convert to equivalent gross salary.

-Military Once Source - for retired pay calculations only.

Again, I invite you to browse these free tools (and any others you may come across), and then compare and contrast them to the MCC.

Yes we could, but that estimate would not be accurate – and it would likely be too low.

Doing so would bypass filing status, state income tax information, and the value of Military Benefits, all of which can greatly affect your equivalent civilian salary.

However, even if we zereod out all the benefits, the tax savings on your allowances would still come into play - and you might be surprised by how much you earn with pays and allowances alone.

This one is up to you. They probably aren’t interested in your current military compensation, especially if it requires them to learn all about the tax advantages of allowances and benefits.

Civilian employers use market compensation rates for their employees, which can vary based on the current demand for your skills and experiences. As a result, your current military compensation isn't a relevant factor to them.

The MCC is more expensive relative to other calculators on the market. This is for a number of reasons:

-High value to you. Spending a couple hundred dollars (or better yet, just $27) for you to be able to run customized scenarios that have accurate Federal, FICA, and state tax estimates can help shape the rest of your working career.

-You have budgeting and financial certainty, that you can’t get anywhere else, unless you hire your own tax professional. That professional may not understand military compensation, and so may not be able to give you an accurate picture of your equivalent civilian salary, anyway.

-The free resources all simplify or downplay the significance of income taxes on your take home income.

Yes, we sure do! If for any reason, you are not 100% satisfied with the MCC, just email me at [email protected], and I will issue you a complete refund, no questions asked.

I want this to be a great experience for you, so even if you don't think the value is there, I hope that you will have walked away with some additional knowledge of taxes and military compensation.

This is a question to ask your elected representatives at the Federal, State, and local level – they’re the ones who write the tax laws.

Book a 30-minute or 60-minute call with me. Have your questions ready to go – or better yet, include them when you book your call so I can review them ahead of time. Check out my main coaching page to learn more.

SEE ALL FAQS (coming soon!)