Compensation Mastery Tool for Military (CMTM) personas

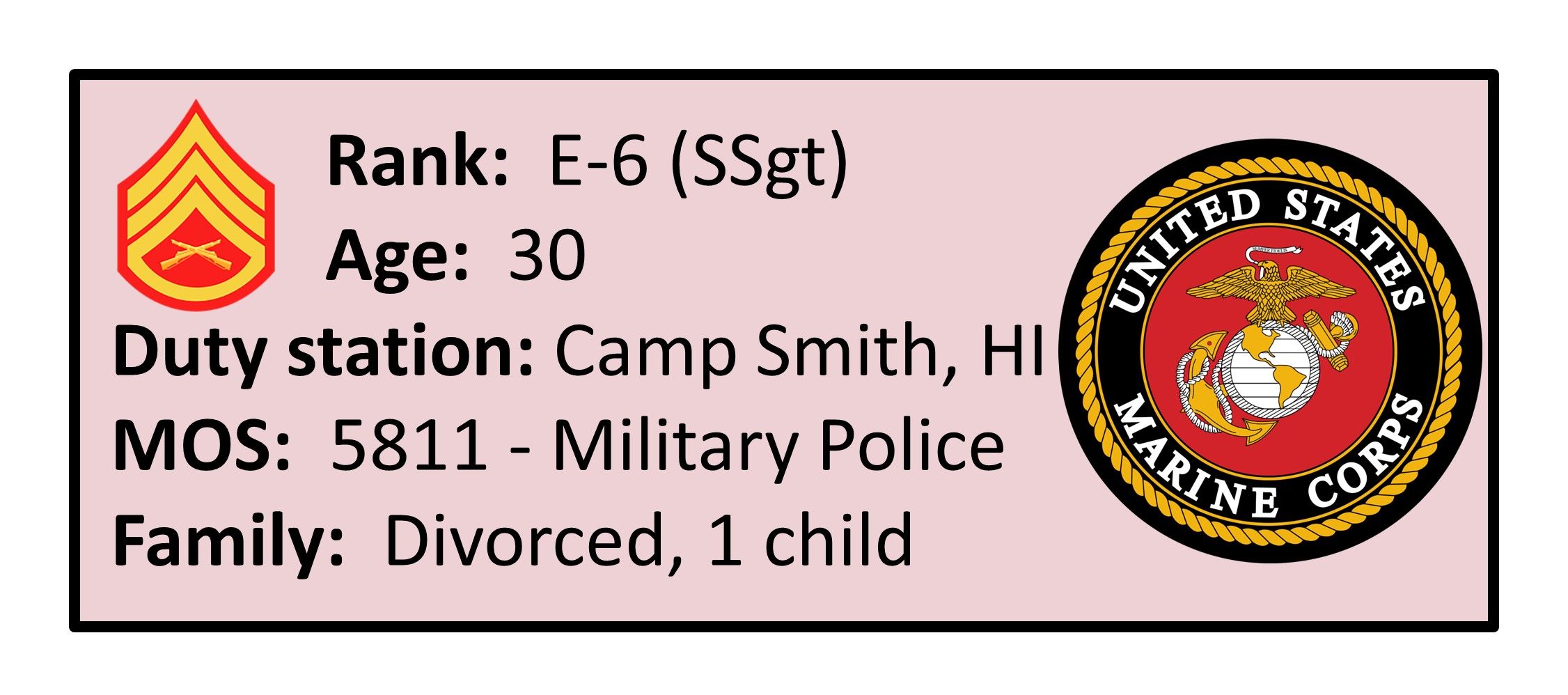

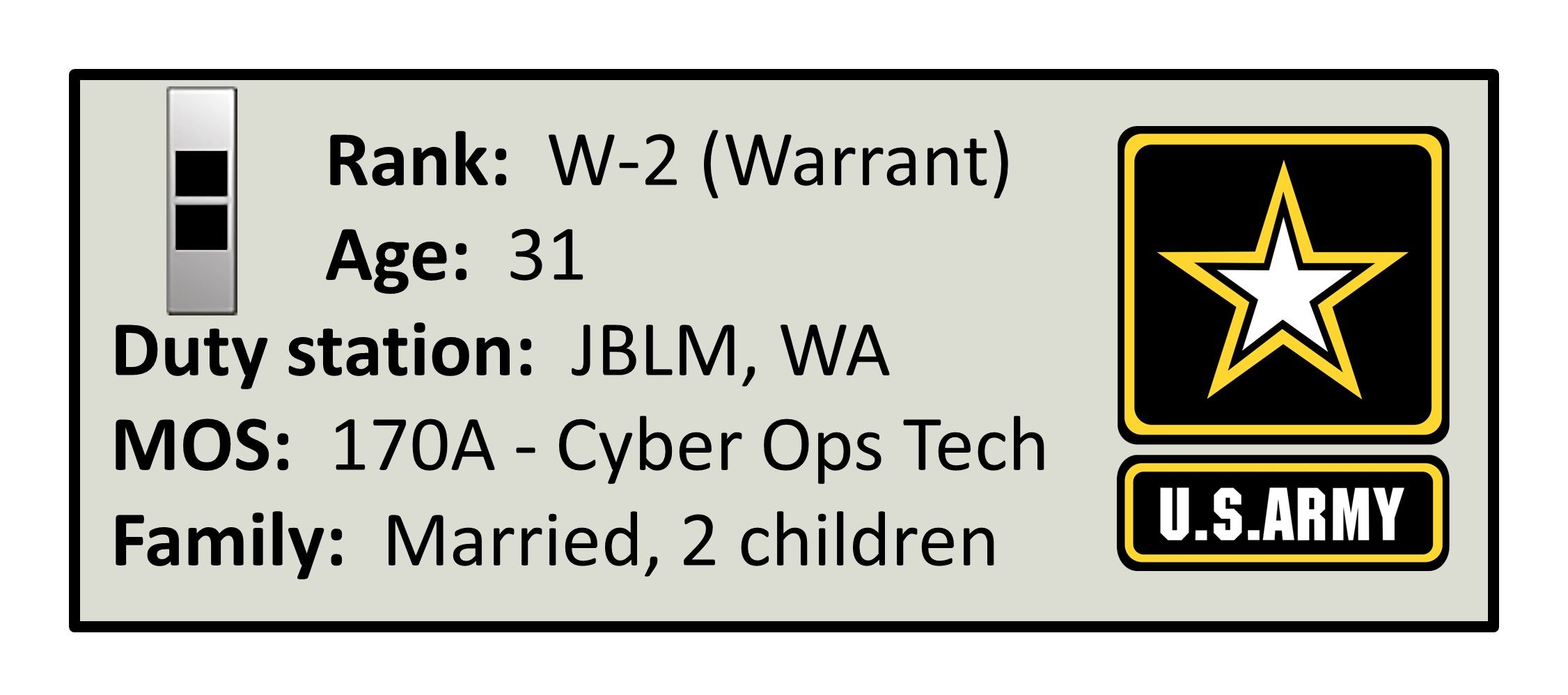

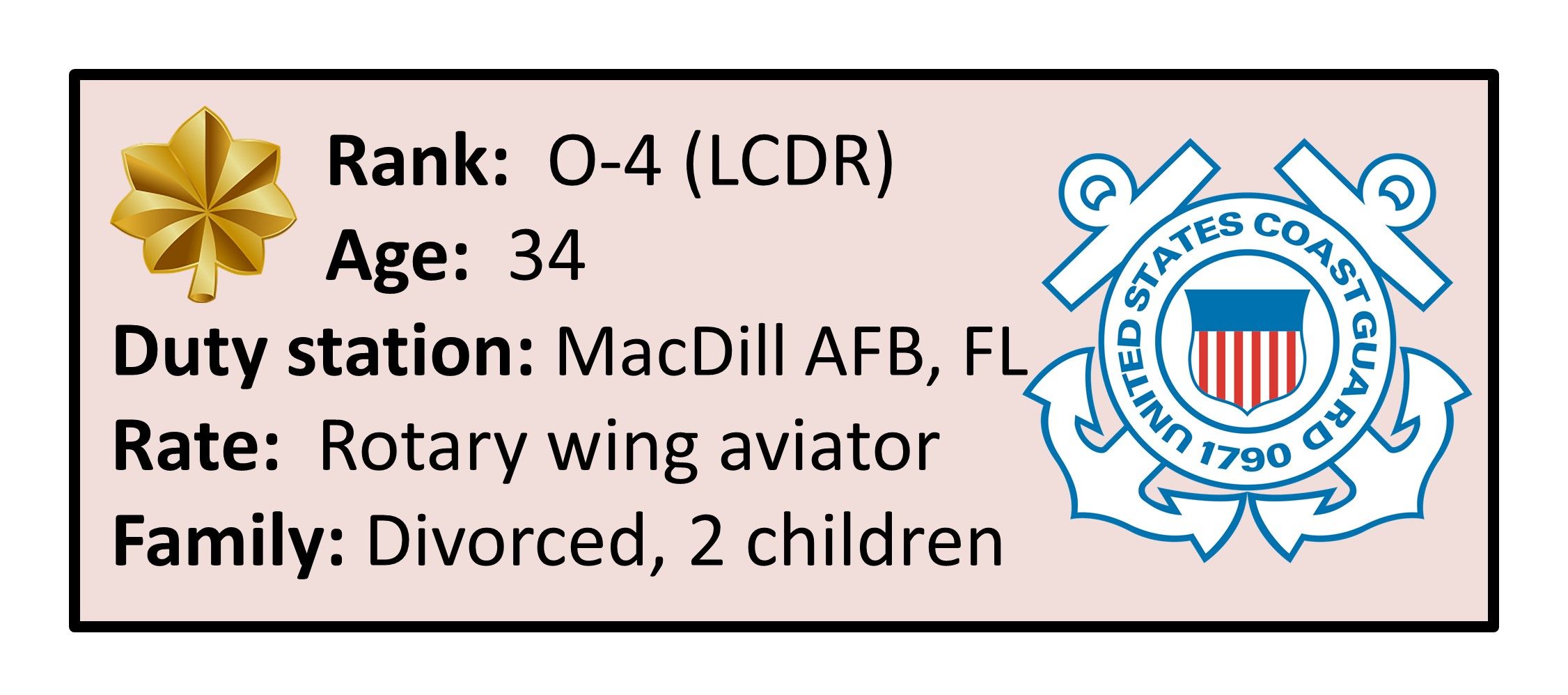

Below are 12 personas that span across pay grade, duty station, state of residency, and tax filing status. Please feel free to review as many as you'd like to get a sense for how total military compensation can greatly vary, based on all these factors.

Click on any of the 12 personas to see a detailed example of how each one benefits from leveraging the CMTM

The table below shows the additional military compensation elements for each persona

Note that the various military compensation elements (Pays, Allowances, and Benefits) can very with each service member, resulting in a unique overall compensation amount for each person.